Your Guide to Medicare Supplement Plans Near Me

Your Guide to Medicare Supplement Plans Near Me

Blog Article

Understanding the Conveniences of Medicare Supplement in Insurance

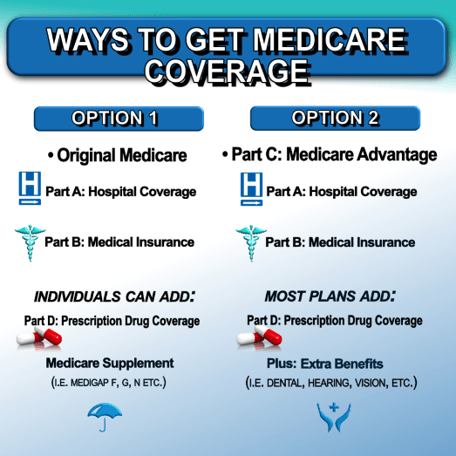

Navigating the facility landscape of insurance coverage choices can be a difficult job, especially for those coming close to retired life age or already registered in Medicare. Nevertheless, in the middle of the variety of selections, Medicare Supplement prepares stick out as a useful source that can give comfort and monetary security. By recognizing the advantages that these strategies use, individuals can make informed choices regarding their healthcare insurance coverage and make certain that their requirements are sufficiently met.

Significance of Medicare Supplement Plans

When considering health care protection for retired life, the value of Medicare Supplement Plans can not be overstated. Medicare, while comprehensive, does not cover all healthcare expenses, leaving people possibly at risk to high out-of-pocket expenses. Medicare Supplement Program, likewise referred to as Medigap plans, are designed to complete the spaces left by standard Medicare insurance coverage. These plans can help cover expenditures such as copayments, coinsurance, and deductibles that Medicare does not pay for.

One of the essential benefits of Medicare Supplement Program is the satisfaction they offer by offering extra economic protection. By paying a regular monthly costs, individuals can much better allocate medical care prices and prevent unexpected medical costs. These plans frequently give insurance coverage for medical care solutions obtained outside the United States, which is not provided by initial Medicare.

Protection Gaps Attended To by Medigap

Dealing with the gaps in protection left by typical Medicare, Medicare Supplement Plans, additionally known as Medigap plans, play a critical function in offering thorough medical care protection for individuals in retirement. While Medicare Component A and Part B cover several health care expenditures, they do not cover all prices, leaving beneficiaries susceptible to out-of-pocket expenditures. Medigap plans are developed to load these protection gaps by spending for certain health care costs that Medicare does not cover, such as copayments, coinsurance, and deductibles.

One of the substantial advantages of Medigap policies is their capacity to supply economic security and tranquility of mind to Medicare beneficiaries. By supplementing Medicare insurance coverage, people can much better manage their healthcare costs and avoid unforeseen monetary burdens connected to treatment. Additionally, Medigap policies use versatility in picking health care carriers, as they are normally accepted by any doctor that approves Medicare task. This flexibility enables recipients to get treatment from a variety of physicians and specialists without network restrictions. On the whole, Medigap strategies play an essential function in guaranteeing that retired people have access to comprehensive health care insurance coverage and economic protection during their later years.

Expense Financial Savings With Medigap Plans

With Medigap policies efficiently covering the voids in conventional Medicare, one noteworthy advantage is the capacity for considerable price financial savings for Medicare recipients. These policies can assist reduce out-of-pocket expenditures such as copayments, coinsurance, and deductibles that are not fully covered by initial Medicare. By filling out these monetary openings, web Medigap prepares offer beneficiaries financial assurance by limiting their general healthcare prices.

In addition, Medigap policies can give predictability in health care spending. With dealt with regular monthly costs, recipients can budget much more properly, knowing that their out-of-pocket costs are a lot more regulated and regular. This predictability can be particularly helpful for those on fixed incomes or limited budget plans.

Flexibility and Freedom of Choice

One of the key advantages of Medicare Supplement Insurance, or Medigap, is the flexibility it uses in choosing health care companies. Unlike some managed treatment strategies that limit individuals to a network of physicians and hospitals, Medigap policies commonly permit beneficiaries to visit advice any medical care company that accepts Medicare.

Essentially, the versatility and liberty of selection paid for by Medigap policies enable recipients to take control of their medical care decisions and customize their healthcare to fulfill their private needs and choices.

Rising Popularity Among Elders

The surge in popularity among seniors for Medicare Supplement Insurance, or Medigap, underscores the expanding recognition of its advantages in enhancing health care protection. As elders navigate the complexities of medical care choices, lots of are transforming to Medicare Supplement plans to fill up the gaps left by traditional Medicare. The tranquility of mind that includes understanding that out-of-pocket costs are minimized is a substantial variable driving the enhanced interest in these plans.

Additionally, the personalized weblink nature of Medicare Supplement plans permits seniors to tailor their insurance coverage to match their individual health care requirements. With a range of strategy choices offered, seniors can pick the mix of advantages that finest lines up with their health care demands, making Medicare Supplement Insurance an attractive selection for numerous older grownups wanting to secure detailed coverage.

Verdict

To conclude, Medicare Supplement Program play an essential function in addressing protection gaps and saving expenses for seniors. Medigap policies give adaptability and flexibility of choice for people looking for extra insurance policy protection - Medicare Supplement plans near me. Because of this, Medigap plans have seen a surge in popularity amongst senior citizens that value the advantages and satisfaction that include having thorough insurance protection

Report this page